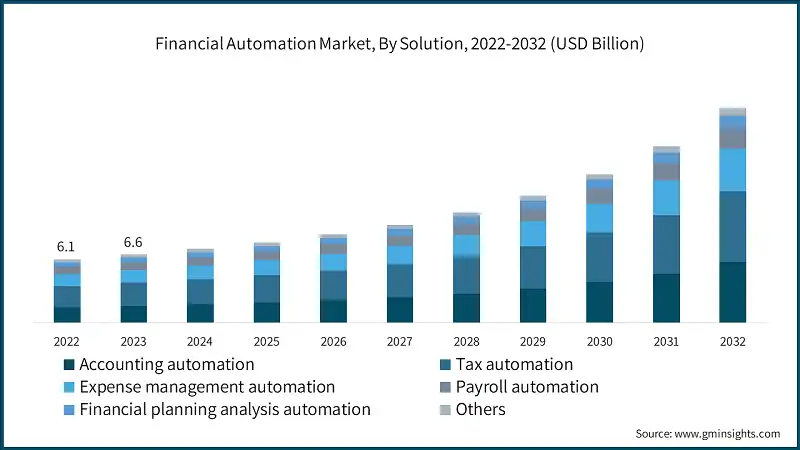

The finance industry is at a crossroads. With 45% of finance tasks still reliant on manual processes, according to a McKinsey & Company report, organizations grapple with inefficiencies, human errors and compliance risks. Add to this, the pressure to deliver real-time financial insights and adhere to ever-evolving regulations, and the need for robust automation becomes undeniable. Enter Boomi workflow automation, a game-changer for financial institutions seeking to modernize operations. Boomi’s low-code, cloud-native platform empowers finance teams to automate workflows from invoice processing to financial reporting while ensuring seamless integration across legacy systems and modern applications.

Organizations leveraging Boomi’s financial data workflow automation have achieved transformative outcomes, such as slashing invoice processing times by up to 80% through automated validation and routing. These results underscore the power of pairing finance IT modernization with agile automation tools to eliminate bottlenecks and drive scalability. In this blog, we dive deeper into how Boomi is reshaping financial operations—enhancing efficiency, ensuring compliance, and building a future-ready infrastructure for the digital age.

What is Boomi Workflow Automation? Simplifying Finance IT Modernization

Boomi’s platform acts as a central nervous system for finance operations, bridging gaps between legacy systems (e.g., on-premises ERPs) and modern cloud applications (e.g., Workday, Salesforce). Its low-code automation in finance empowers teams to visually design workflows using drag-and-drop components, eliminating dependency on specialized coding skills. Pre-built connectors for systems like SAP, Oracle, and SWIFT enable seamless financial system integration solutions, reducing implementation time by up to 70% compared to traditional coding (Boomi Finance Solutions). Real-time data synchronization ensures that critical processes such as procure-to-pay or month-end close operate with up-to-the-minute accuracy, minimizing reconciliation errors.

Key Points:

- Low-code agility: Build workflows for approvals, reconciliations, or compliance checks without deep technical expertise.

- Unified ecosystem: Connect banking APIs, ERPs, and CRM systems in a single interface.

- Scalability: Automate processes across global subsidiaries while adhering to regional compliance standards.

Benefits of Boomi Workflow Automation for Finance Teams

Boomi drives operational efficiency, cost savings, and compliance readiness through intelligent automation.

By automating repetitive tasks like invoice validation and expense reporting, Boomi reduces manual effort by up to 80% (BuiltIn). Its real-time financial data processing capabilities ensure that financial close cycles shrink from weeks to days, as data from disparate sources is aggregated, validated, and reconciled automatically. For compliance, Boomi’s audit trails log every transaction and data movement, simplifying audits and ensuring adherence to GDPR, SOX, and other regulations. Additionally, automated alerts flag anomalies—such as duplicate payments or unauthorized expenses—before they escalate.

Key Points:

- Faster processing: Automate invoice approvals, reducing cycle times from days to hours.

- Error reduction: Eliminate manual data entry mistakes with automated validation rules.

- Cost optimization: Reduce operational costs by 30-50% through streamlined workflows (McKinsey & Company).

Automating Financial Workflows with Boomi

Boomi addresses critical finance challenges, from procurement to compliance reporting.

Use Cases:

- Procure-to-Pay Automation: Boomi integrates vendor portals, ERPs, and payment gateways to automate PO matching, GR/IR reconciliation, and payment processing. For instance, purchase orders can auto-populate in ERPs, while invoices are validated against contracts in real time.

- Automated Expense Management: Sync corporate card transactions with accounting systems, auto-categorize expenses, and enforce policy compliance.

- Financial Reporting: Generate balance sheets, cash flow statements, and audit reports by pulling data from multiple sources into unified dashboards.

Key Points:

- End-to-end visibility: Track procure-to-pay or order-to-cash workflows in a single pane.

- Dynamic scalability: Handle seasonal spikes (e.g., year-end closing) without additional staffing.

Boomi Integration for Real-Time Financial Data Management

Boomi breaks down data silos, enabling real-time decision-making.

Boomi’s integration platform-as-a-service (iPaaS) connects cloud apps, databases, and APIs to create a unified data ecosystem. For example, transaction data from banking APIs can flow into ERPs for real-time cash flow analysis, while customer payment histories sync with CRMs to improve collections strategies. Boomi’s secure automation for finance data integration encrypts data in transit and at rest, meeting FINRA and PCI-DSS standards.

Key Points:

- API-led integration: Build scalable connections for real-time payment tracking or fraud detection.

- Data governance: Maintain golden records with automated deduplication and cleansing.

Low-Code Finance Process Automation: Empowering Non-Technical Teams

Boomi Flow democratizes automation, enabling business users to innovate.

Boomi Flow’s drag-and-drop interface lets finance teams design workflows for tasks like budget approvals or vendor onboarding. Pre-built templates for journal entries, expense claims, or tax calculations accelerate deployment. For example, a finance analyst can automate month-end accruals by setting up rules to pull data from ERPs, apply adjustments, and push finalized entries to reporting tools, all without writing code.

Key Points:

- Rapid prototyping: Test and deploy workflows in days, not months.

- Collaboration: Business and IT teams co-design workflows using shared visual tools.

Compliance and Audit Readiness Through Boomi Workflows

Boomi ensures transparency and accuracy for regulatory compliance.

Boomi automates SOX controls by embedding checks into workflows; for example, validating that purchase approvals follow dual-authorization rules. Its immutable audit logs record every data transaction, including timestamps and user IDs, simplifying internal and external audits. Additionally, Boomi’s compliance and audit readiness workflows auto-generate compliance reports (e.g., anti-money laundering checks) and flag discrepancies in real time.

Key Points:

- Automated controls: Enforce policies like segregation of duties (SoD) across workflows.

- Audit trails: Maintain a tamper-proof record of all financial transactions.

Conclusion: Elevating Finance Excellence with Boomi’s Automation Edge

Boomi workflow automation transcends traditional tools, emerging as an indispensable ally for finance teams navigating the dual demands of agility and compliance. By streamlining procure-to-pay workflows, automating financial close cycles, and enabling secure automation for finance data integration, Boomi empowers organizations to modernize legacy systems while scaling innovation. Its adaptability positions it as the backbone of finance IT modernization, turning fragmented processes into cohesive, real-time operations.

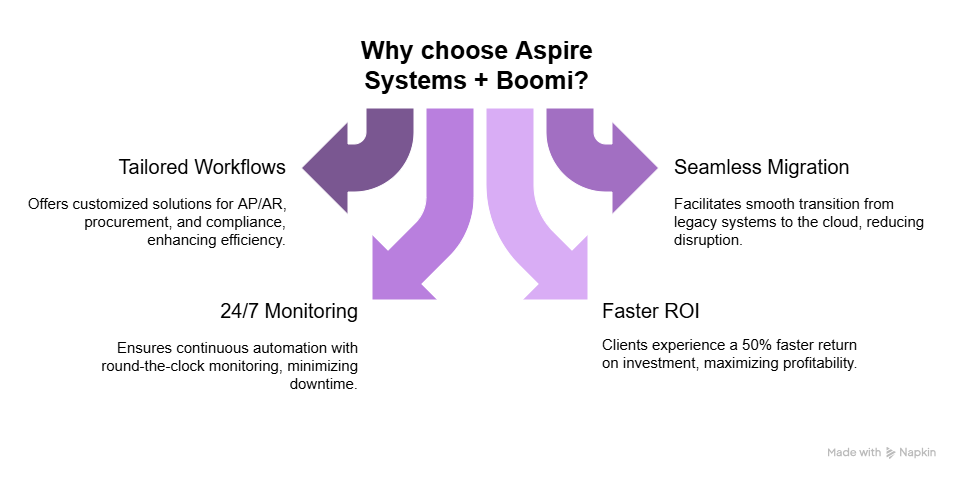

At Aspire Systems, we bridge Boomi’s technical prowess with industry-specific expertise to craft automation strategies that deliver measurable value. Whether you’re modernizing legacy architectures, automating complex reconciliations, or building low-code automation in finance for rapid scalability, our solutions ensure your automation journey aligns with business goals and regulatory mandates.

Ready to unlock the future of finance? Partner with Aspire Systems to ignite your Boomi-powered transformation; where efficiency meets compliance, and innovation drives growth.

Related Blogs:

Boomi’s AI-Powered MDM: Maximizing Data Accuracy Across Enterprises

Optimizing Integration Processes through Boomi’s AI-Enhanced API Management

Is Your E-commerce Data a Liability? Boomi MDM Transforms It into an Asset

Boomi: Championing Faster Integration with the Power of Low-Code

Write to Us

Write to Us