Summary

- Customer experience provided by the bank is one of the leading causes that plays a vital role in the customers’ decision making for staying or leaving the bank.

- Deployment of artificial intelligence in the banking with capabilities like chatbots alone are estimated to bring in additional revenue of 3.6 million dollars (this is just through their usage in front office functions).

- AI can create trust and build positive relationships with customers through safety features and personalized interactions.

- Your customers can leverage the help of your AI and use it to create investment strategies that are best for them and their investment goals.

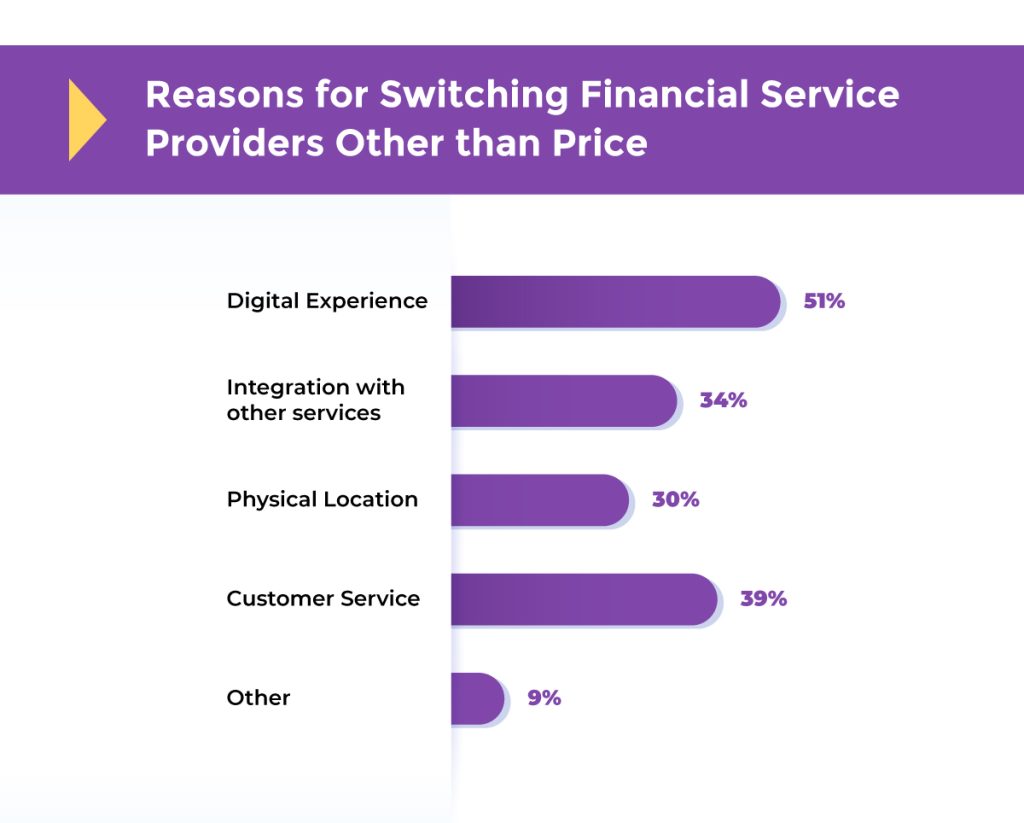

In 2022, 3 of the 25% of global banking customers who switched their banks cited poor customer experience. The involvement of artificial intelligence in banking can change this situation and secure customer satisfaction. In today’s uncertain economic climate, customers seek clarity and consistency from their financial institutions. They’re also more willing to switch banks if their expectations aren’t met. To keep up, banks must prioritize better customer experience.

Artificial intelligence (AI) can help banks deliver seamless digital experiences and personalized support anytime, anywhere, on the platforms customers prefer. According to McKinsey’s 2023 banking report, generative AI could increase banking sector productivity by up to 5%, potentially saving the industry $300 billion globally.

In this article, we will look into different benefits you can provide your bank or financial institution to your customers through AI to enhance customer experience.

Table of content

- Instant Responsive Help Center

- Building Security and Assuring Confidence

- Personalized Investment Strategist

- Individualized User Experience

- Management of Financial Products

Instant Responsive Help Center

AI-powered chatbots and virtual assistants can address customer needs promptly when human support isn’t available. From identifying surplus funds to allocate to savings, alerting customers about unusual account activity, or offering tailored financial advice, AI can handle various tasks with efficiency.

For instance, Bank of America’s chatbot, Erica, has managed over 1.5 billion customer interactions since its launch in 2018. This technology has revolutionized round-the-clock assistance, minimizing wait times and enhancing customer satisfaction. According to Deloitte, global investment banks could see a 27-35% boost in front-office productivity with generative AI, leading to $3.5 million in additional revenue per employee by 2026.

Building Security and Assuring Confidence

AI strengthens security by monitoring and analyzing transactions in real time to detect fraud. Barclays, for example, uses AI to identify suspicious activities before they affect customers. This proactive approach safeguards customer accounts while instilling trust in the bank’s security measures.

Personalized Investment Strategist

AI platforms like Bank of America’s Glass integrate machine learning to analyze market trends and predict client needs. By offering tailored investment insights, these platforms help customers make informed decisions and position banks as leaders in innovative financial solutions.

Individualized User Experience

AI adapts to users’ preferences by analyzing their interactions with banking platforms. For example, if a customer frequently checks their investment portfolio, the app’s dashboard might be adjusted to prioritize those features. Similarly, users who regularly make international transfers will find these options prominently displayed.

This customization extends beyond functionality to visual aspects, such as themes and layouts. A minimalist interface may be designed for users who prefer simplicity, while data-rich dashboards cater to those interested in detailed analytics.

Management of Financial Products

An efficient Artificial intelligence established in your banks can assist your customers in managing various products and services that are offered from you to them. Customers can know, keep track of, and receive guidance towards raising the credit score. An enhanced AI can also be trained to perform various functions, for instance customers through the help of an AI can modify banks information, set up automatic payments, receive alerts when payments are due, and more. AI can also provide assistance to your customers to expedite their insurance claims and loan application, this is done through personalized solution suggestions and checklists.

How Can Aspire Help?

By integrating AI, banks can provide customers with valuable insights, better financial control, and enhanced security. Aspire specializes in AI technologies for banking, offering tailored solutions to help institutions deliver exceptional customer experiences. With expertise in strategizing and implementing AI-driven initiatives, Aspire supports banks in staying ahead in a competitive market.

Artificial intelligence in banking is no longer just a convenience—it’s a necessity for meeting the demands of today’s customers. By leveraging AI effectively, banks can ensure a more responsive, secure, and personalized banking experience.

- Unlocking the Potential of AI in Payment Solutions - March 25, 2025

- How to leverage Payment Innovation of the Middle East with ISO 20022 - December 26, 2024

- How Artificial Intelligence in Banking Transforms Customer Experience - December 9, 2024

Write to Us

Write to Us