Introduction

The robot apocalypse. The rise of Skynet. The fear that AI will snatch our jobs and leave us obsolete. These are the narratives that often dominate discussions about artificial intelligence, particularly in the banking sector. But what if we’ve got it all wrong? What if, instead of a battle for supremacy, the future of banking lies in a harmonious partnership?

In this Blog, Let’s explore the concept of the symbiotic relationship between AI and human bankers, a collaboration that promises to revolutionize the industry and benefit everyone involved.

The AI Side of the Symbiosis, Supercharged Analytical Power

AI excels at tasks that are repetitive, data-intensive, and require lightning-fast processing. Think of AI as the bank’s super-powered analytical tool, able to sift through millions of transactions in seconds.

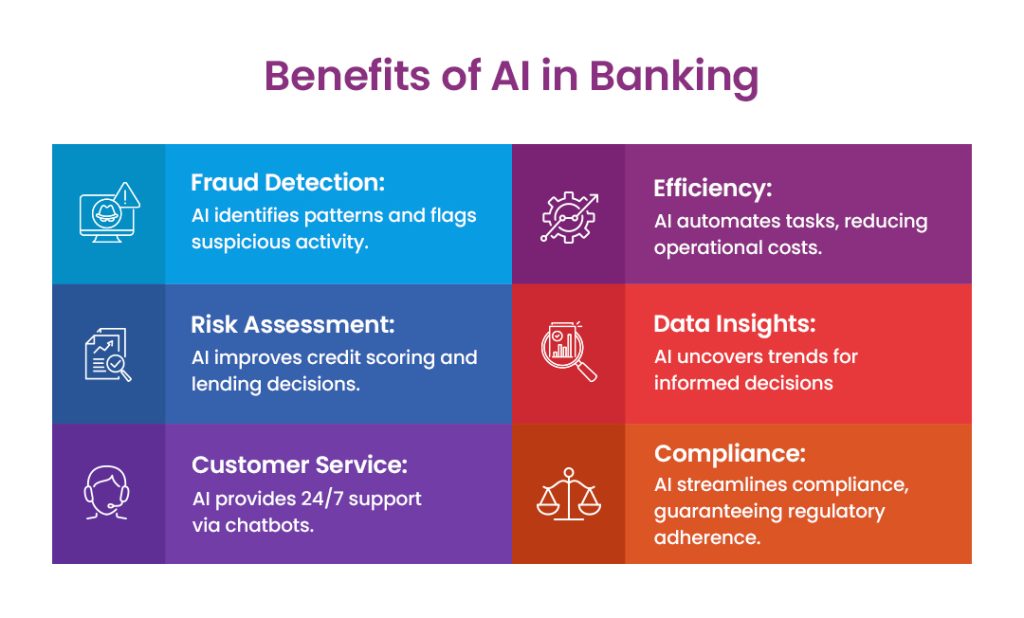

In areas like fraud detection, AI can identify patterns and anomalies that would be impossible for humans to spot, preventing financial losses and protecting customers. In risk assessment, AI can analyze vast datasets to provide more accurate credit scores and lending decisions, reducing defaults and improving portfolio performance. And in personalized customer service, AI-powered chatbots and virtual assistants can provide instant support, answer queries, and offer tailored recommendations, enhancing customer satisfaction.

In essence, AI in Banking acts as a super powered analytical tool, able to sift through millions of transactions in seconds, while providing the above benefits, therefore revolutionizing banking operations.

The Human Side of the Symbiosis, The Irreplaceable Touch

While AI handles the heavy lifting of data analysis and automation, human bankers bring the irreplaceable qualities of judgment, empathy, and creativity. Humans provide the vital emotional intelligence needed to handle sensitive customer situations, build long-lasting trust, and navigate complex financial decisions. They understand the nuances of human behavior, the importance of personal relationships, and the need for ethical considerations. Human bankers are also the innovators, the problem-solvers, and the strategists who can leverage AI insights to develop new products, improve processes, and create a more customer-centric banking experience.

Examples of Successful AI Human Symbiosis

The AI-human symbiosis is not just a theoretical concept; it’s already happening in banks around the world.

- Consider a loan officer using AI-powered risk assessment to more effectively help small businesses gain access to capital. The AI provides data-driven insights, while the human provides personalized guidance and support, ensuring that the loan is tailored to the specific needs of the business.

- Imagine a customer service representative using AI-powered chatbots to handle routine queries, freeing up their time to focus on more complex and sensitive customer issues.

These are just a few examples of how AI is empowering bankers to be more effective and efficient.

The Future of Banking: Enhanced by AI

The AI-human symbiosis will continue to evolve and transform the banking industry. As AI technology advances, we can expect to see even more sophisticated applications in areas like predictive analytics, personalized financial planning, and automated compliance. However, the human element will remain crucial. The future of banking is not humans replaced by AI, but humans enhanced by AI. For instance, according to an article by Mckinsey “AI technologies could potentially deliver up to $1 trillion of additional value each year” which proves that AI acts as a super powerful analytical tool for banks.

Here are other such use cases where the symbiotic relationship between AI and Bankers will lead to success:

1. Research by Juniper predicts that online payment fraud globally is expected to reach $206 Billion by 2025.

Solution: Machine learning algorithms can analyze vast datasets to identify patterns indicative of fraudulent activity with far greater accuracy than human analysts. Making AI in banking a perfect match

2. A Salesforce study revealed that 71% of customers expect companies to understand their unique needs and expectations.

Solution: AI-driven personalization, through data analytics and customer segmentation, enables banks to offer tailored financial products and services. For instance, AI-powered chatbots can provide 24/7 customer support, while predictive analytics anticipate customer needs, enhancing satisfaction and loyalty.

3. A study by PWC found that more than74% of consumers prefer human interaction over automated channels when dealing with complex financial issues.

Solution: While AI excels at data analysis, humans provide the emotional intelligence and critical thinking necessary for complex decision-making and relationship building. This data highlights the irreplaceable role of human judgment and empathy in banking.

To prepare for this future, banks must invest in training and development programs that equip their employees with the skills they need to work alongside AI. This includes developing skills in data literacy, AI ethics, and human-centered design.

Conclusion: A Flourishing Future

The AI-human symbiosis offers a powerful and optimistic vision for the future of banking. By embracing this partnership, banks can unlock new levels of efficiency, innovation, and customer satisfaction. AI provides analytical power, while humans provide emotional intelligence and strategic thinking. This creates a win-win scenario for banks, customers, and employees. Banks can reduce costs, improve risk management, and enhance customer loyalty. Customers can enjoy more personalized and convenient services. And employees can focus on more meaningful and fulfilling work.

Let’s move away from fearmongering and embrace the potential of this symbiotic relationship. The future of banking is not about machines replacing humans; it’s about machines and humans working together to create a better financial world. Aspire systems offers such an efficient symbiotic AI based banking services.

Write to Us

Write to Us